Charter rates finally collapse and fall in line with freight rates

(Alpha Liner)

Issue-52/2022

The extraordinary trading conditions enjoyed in 2021 by Non-Operating Owners (NOOs), liner operators and freight forwarders on the back of the unprecedented Covid-related demand bonanza continued in the first half of 2022.

But a gradual normalization of cargo flows, the return of capacity previously tied up by congestion, skyrocketing energy prices caused by the war in Ukraine, and galloping inflation which bit into consumers’ spending power, dramatically reversed the fortunes of the market’s stakeholders from the second half of the year.

The reduced head haul cargo demand on many key routes translated into fast falling cargo rates, with charter rates following suit in the last quarter of the year.

Just as in 2021, the two Shanghai Shipping Exchange (SSE) freight indices covering box rates out of China, the Shanghai Containerized Freight Index (SCFI) and the China Containerized Freight Index (CCFI), and the Alphaliner Charter Rate Index (ACI) dealing with containership charter rates, evolved in 2022 in a similar, but not fully synchronised way.

After rising strongly at different speeds in 2021, the box and charter indices both collapsed in 2022, albeit the charter index adjusted to the market downturn with a longer time lag.

Whilst the SCFI reached its peak of 5,109 points on 7 January, and the CCFI 3,587 points on 11 February, the ACI was at a historic high a little later in March, at 563 points.

Both the SCFI and CCFI indices then started to fall until June, when they gently picked up again.

This was however to be a short-lived rally, with the indices resuming their descent in July. From that point onwards, they would fall at an uninterrupted and much faster pace, particularly the SCFI which by September had crashed to 2,800 points, just over half its peak value of January.

Trade slowdown to worsen in 2023: UNCTAD

(Seatrade Global)

Tuesday, 13 December 2022

UNCTADUNCTAD_Trade_Growth

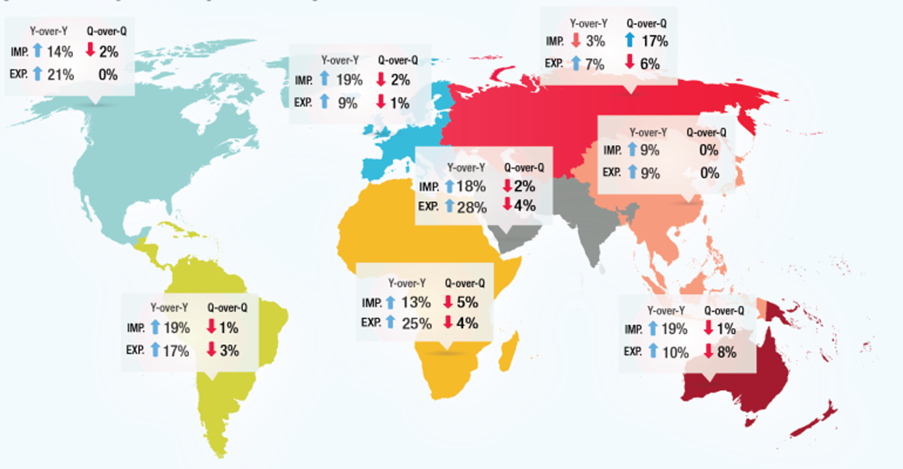

A decline in global trade in the third quarter 2022 is expected to get worse in 2023, according to the United Nations Conference on Trade and Development (UNCTAD).

Gary Howard | Dec 13, 2022

The UN trade body’s Global Trade Update for December 2022 noted that after a record year, global trade growth had turned negative in the second half of 2022.

UNCTAD pegged global trade at $32trn for 2022, comprising $25trn in goods and $7trn in services. Those estimates represent a 10% increase in trade of goods over 2021, and a 15% increase in services.

“Those record levels are largely due to robust growth in the first half of 2022. Conversely, trade growth has been subdued during the second half of the year,” said UNCTAD. It’s figures show a 1% drop in the trade of services in Q3 2022 compared to Q2 2022, with a 1.3% increase in trade of services.

UNCTAD’s nowcast assessment of current trade “indicates that the value of global trade will decrease in Q4 2022 both for goods and for services.”

While its preliminary figures show a drop in value for the trade of goods, volumes rose by 3% which UNCTAD said reflects resilience in global demand. Other positive factors noted in the report included an improvement in logistics, lower congestion and falling freight rates.

Trade patterns were being influenced by a reshaping of global supply chains through sourcing diversification, reshoring and near-shoring, all of which are expected to impact trade in the coming year. Trade patterns will also reflect movement towards a greener economy, with carbon intensive goods and fossil fuel energy falling out of favour.

On the negative side, UNCTAD listed factors including lower economic growth and the high price of goods. High energy prices are bringing down economic forecasts as interest rates rise, while related increases in the price of goods and inputs soften import demand.

The combination of rising interest rates and record levels of global debt bring growing concerns over debt sustainability, said UNCTAD, especially for highly indebted governments in an environment of tightening financial conditions.

“The ongoing trade slowdown is expected to worsen for 2023. While the outlook for global trade remains uncertain, negative factors appear to outweigh positive trends,” said UNCTAD.

Carrier share prices collapse by up to 70% in 2022

(Alpha Liner)

Issue-01/2023

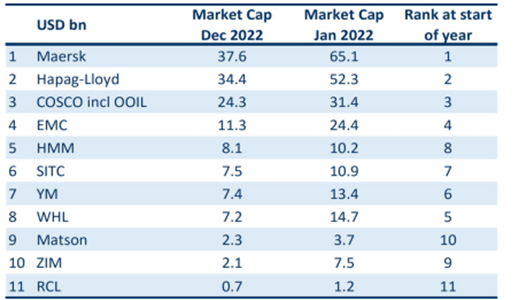

Container stocks lost between 20% and 70% of their value over the course of 2022, with ZIM punished the most by investors over fears the carrier’s future earnings will not cover expensive charter contracts.

ZIM’s stock traded at USD 17.19 on the last day of the year, down 70% from its January debut of USD 56.76. Meanwhile, Wan Hai Lines, Evergreen Marine and COSCO have seen their share prices halved between January and December.

Elsewhere, Matson, HMM and OOIL recorded the smallest price declines, at between 21%-29%, but this was distorted by the timing of their stock performance. HMM’s shares peaked, and took the majority of their losses, in 2021, while OOIL and Matson peaked later in Q1 2022 reducing the January-December loss. Both carriers are currently trading at 50% off their 52-week highs.

Hapag-Lloyd and Maersk meanwhile saw their stock fall 38% and 35% from January to December, though Maersk held up better. It is 36% off its 52-week high while Hapag-Lloyd is off 60%.

Overall, the 11 publicly listed container carriers saw approximately USD 90 bn wiped off their market capitalisation between the start and the end of 2022, as rate prospects and the rapid unwinding of shipping congestion spooked investors even as financial results remained strong.

Today’s collective market capitalisation for the 11 carriers (converted to US dollars at current exchange rates) however remains at USD 145 bn, or 2.3 times higher than pre pandemic levels.

Although plunging freight rates have left investors nervous, attention could switch to the underlying value in the companies if rates were to stabilise for a consistent period. All of the carriers now hold substantial cash reserves:

CN analysis: Box carriers’ rate struggle on India trades continues amid demand challenges

(Container News)

Tuesday, 03 January 2023

Container carriers serving Indian trades continue to face steep freight rate declines amid a weakening demand outlook that industry observers believe will only worsen in the days ahead, according to a new market analysis by Container News.

On the westbound India-Europe trade, average contract rates from West India [Jawaharlal Nehru Port (JNPT)/Nhava Sheva or Mundra Port] to Felixstowe/London Gateway (UK) or Rotterdam (the Netherlands) crashed to US$1,300 per 20-foot container and US$1,600/40-foot container at the end of last month, from US$2,300 and U$2,500, respectively, in November.

For West India-Genoa (the West Mediterranean) cargo, average rates stood at US$1,500/20-foot box and US$1,600/40-foot box, compared with the November levels of US$2,200/20-foot box and US$2,500/40-foot box.

December eastbound cargo (imports into India) prices for these port pairings, however, saw no noticeable changes month-on-month, with continuing to hover at US$1,400/TEU and US$1,500/FEU for bookings from Felixstowe/Rotterdam and at US$1,150/TEU and US$1,400/FEU to West India (Nhava Sheva/Mundra).

Average short-term contract prices offered by major carriers for Indian cargo moving to the US East Coast (New York) also saw steep declines from the November levels – down to US$3,700 per 20-foot box, versus US$4,700, and US$5,000 per 40-foot box, from US$6,300, and at US$2,100/20-foot container, from US$3,600, and US$3,000/40-foot box, down from US$4,800, for shipments to the US West Coast (Los Angeles).

For the West India-US Gulf Coast trade, rates on average fell to US$3,900 per 20-foot container and US$5,200 per 40-foot container, compared with US$4,750 and US$6,850, respectively, during November.

On the return direction, average contract rates saw no changes from the levels maintained by major operators in November, with the exception of USEC-West India bookings. According to the CN analysis, December rates stood at US$900/TEU, down from US$1,075, and US$1,125/FEU, down from US$1,450, from USEC; at US$2,484/TEU and US$ 3,193/FEU from USWC; and at US$1,770/TEU and US$1,843/FEU from the Gulf Coast, into West India (Nhava Sheva/Mundra).

Rates on intra-Asia trades out of India also dropped measurably in December from the month-ago averages, with West India-South China cargo seeing the steepest hit – down by nearly 50% to US$257/20-foot box and US$382/40-foot box, versus US$500 and US$750, respectively, in November, the analysis showed.

Average contract rates offered by major carriers to regular clients for bookings from West India (Nhava Sheva/JNPT or Mundra) to Shanghai (Central China) fell to US$125 per 20-foot container and at US$130 per 40-foot box, versus US$150 and US$250, respectively, in November. For Indian cargo to Tianjin (North China), rates were down to US$150/20-foot box and US$300/40-foot container, from US$200 and US$350 in November.

For Indian shipments to Hong Kong, average rates hovered at US$125/TEU and US$130/FEU, down from US$150 and US$200, according to the CN analysis.

December rates on West India-Singapore cargo remained unchanged at US$50/TEU and US$100/FEU, month-on-month.

Contract rate levels on the return leg continued to drop, with the slide averaging between 15 and 25% for bookings from Shanghai/Tianjin to West India from the November levels, according to the CN analysis.

Amid the market challenges, carriers have begun to rework their vessel deployment strategies to stay profitable.

"Vessel deployment and port call adjustments depend on various factors and hence, keep changing all the time," said Sunil Vaswani, executive director of the Container Shipping Lines Association (CSLA) in India.

Vaswani further noted, "Optimisation of vessel space is obviously one of the key considerations while allocating space (to demand areas), thereby helping the lines to service the trade at large better."

He went on to add, "Operational costs also play a role while deciding port rotation and, in that respect, ports globally compete with each other to attract more traffic. Indian ports are no exception. This is even more so when volumes and revenues decline."

According to Bharat Thanvi, co-founder of Mumbai-based digital forwarder Freightwalla, major trades out of India witnessed a 45% rate slide from August through October 2022.

"By the end of 2022, if the demand does not increase, the rates are expected to witness further downfall," Thanvi said.

He further said, "What we are seeing now is dipping demands from the US, UK and other major regions due to high inflation. Moreover, the production in US factories has also seen a worrisome decline in the past couple of months."

He went on to explain, "US manufacturing order to China have declined 40%. The USA commerce department reported the sharpest dip in the retail sales in 11 months. There is an effect seen at Indian ports as well, the rates for TEU and 40-foot containers from Nhava Sheva to the Adriatic, Baltic, and other regions have decreased by an average of US$1000 just in the past 50 days. This trend witnessed its worst turn in the first half of December where the rates suffered a major setback just ahead of the holiday season."

India - USEC service ‘Indamex 2’ adds Jeddah call

(Alpha Liner)

Issue-01/2023

Hapag-Lloyd and CMA CGM will temporarily add Jeddah to the west[1]bound leg of their joint Indian Subcontinent – US East Coast ‘India America Express 2’ service, also known as the ‘Indamex 2’ or ‘IN2’.

Since the departure of the 6,612 teu SWANSEA from Port Qasim on 31 December, the rotation has become: Port Qasim, Mundra, Nhava Sheva, Jeddah, Norfolk, Charleston, Savannah, Port Qasim.

The service’s former call at New York, the last loading port on the US East Coast, still features in the carriers’ proforma schedules, but it continues to be ‘omitted’ for the time being.

The ‘Indamex 2’ or ‘IN2’ service turns in eight weeks with eight ships from 4,600 to 6,966 teu. Five of these are provided by Hapag-Lloyd and three by CMA CGM.

Forward schedules of CMA CGM suggest that Jeddah will be served for a period of two months.

MSC launches a ‘new’ India - East Med service

(Alpha Liner)

Issue-01/2023

In parallel with the launch of its new ‘India to West Med’ service and the closure of its India - Med - USEC ‘Indus 2’ loop, MSC appears to have started a new link between the Eastern Mediterranean and India. MSC already operated a somewhat similar service from 2020 to 2022.

The Swiss carrier’s new ‘India to East Med’ connection offers weekly service and its return sailings from the Med to India are routed via the Middle East Gulf.

Contrary to MSC’s new ‘India to West Med’ service, which the ship[1]ping line started in December after an official announcement, the company has so far not formally announced the new ‘India to East Med’ offer yet.

Alphaliner nevertheless understands that the rotation will include calls at Khalifa Seaport (Abu Dhabi), Hamad (Doha), Jubail, Khalifa Seaport, Karachi, Hazira, King Abdullah Port, El Dekheila

(Alexandria), Tekirdag, Mersin, King Abdullah and Khalifa Seaport.

The exact rotation remains to be confirmed.

MSC offered a first sailing with the 4,432 teu MSC HOUSTON, which set sail from Khalifa Seaport on 12 December.

The carrier’s intention however, is to deploy five or six ships of at least 8,000 teu. The first of these, namely the 8,034 teu MSC RITA, the 8,400 teu MSC SILVANA, and the 8,814 teu MSC MUMBAI VIII, have meanwhile joined the fleet of the new service.

MSC already offered a direct Indian Subcontinent - East Med service from August 2020 to October 2022. At the time, this loop was simply branded ‘India-Med’.

Asian carrier group extends China – Gulf loop to Qatar

(Alpha Liner)

Issue-01/2023

Pacific International Lines (PIL), KMTC, Regional Container Lines (RCL), China United Lines (CULines) and Wan Hai will extend their joint China – Middle East service to Hamad Port in Qatar.

At the same time, the five carriers will also add a westbound call at Singapore to the service.

This China - Gulf loop was launched in November 2021 by four of today’s five partners, with Wan Hai only joining the loop as a vessel provider in March 2022.

Emirates Shipping Lines then started co-loading on this loop in July 2022, but the carrier is not a vessel provider.

PIL and KMTC markets loop as the ‘GCS’, while RCL, CULines, Wan Hai and ESL brand it as ‘RCG’, ‘AGX’, ‘AM1’ and ‘CGX’, respectively.

The expanded ‘China – Gulf’ service continues to turn in seven weeks with seven ships from 3,900 to 6,300 teu.

It will henceforth call at Shanghai, Ningbo, Nansha, Shekou, Singapore, Jebel Ali, Dammam, Hamad Port (aka Doha New Port), Singapore, Shanghai.

This revised rotation will come into effect on 9 January, with the departure of the 4,532 teu WAN HAI 512 from Shanghai.

AD Ports Group and Invictus Consortium sign port development agreement with Sudan

(Seatrade Global)

Wednesday, 14 December 2022

A consortium led by AD Ports Group and Invictus Investment has signed an initial agreement with the Government of the Republic of Sudan that provides them with the right to develop, manage, and operate port and economic zone assets in Sudan.

The agreement will give the consortium the sole right to develop, manage, and operate specified port and economic zones assets and to create joint ventures, partnerships, or other business agreements to support the financing, development, construction, management, and operation of the projects.

Saudi newspaper Arab News said the deal involved development and operation of a $6 billion port and economic zone facility at Abu Amama, on the Red Sea. “The project, located about 200 km north of Port Sudan, would include an economic zone, an airport and an agricultural zone of 415,000 acres,” it said.

“AD Ports Group continues to extend its international reach under the guidance and direction of our wise leadership, supporting the development of port and trade assets in key markets around the world,” said Capt. Mohamed Al Shamisi, managing director and group CEO, AD Ports Group.

“We are grateful and honoured by the trust that the government of Sudan has placed in our consortium by signing this agreement and we look forward to working with them on the development and management of key facilities.”

Arab News quoted Sudan’s finance minister Jibril Ibrahim as saying the country would be entitled to 35 percent of the net profits from the Abu Amama venture.

According to AD Ports, Sudan is a major trading partner of the UAE. During the last 25 years, exports from the UAE to Sudan have increased at an annualised rate of 14.6 percent, from $37.8m in 1995 to $1.14bn in 2020, with key exports including raw sugar, jewelry, and broadcasting equipment, while exports from Sudan to the UAE have increased at an annualised rate of 18.4 percent, from $27.3m in 1995 to $1.86bn in 2020.

Earlier this year, AD Ports Group and Invictus Investment launched an international dry bulk shipping service to serve as the carrier for Invictus’ dry-bulk trading business, which is a major transporter of commodities to and from the Sudanese market, AD Ports said.

“Invictus Investment is proud to be part of the consortium selected by the Government of the Republic of Sudan for this important agreement. Drawing on our deep experience of working with customers in Sudan, and working alongside AD Ports Group, which is the premier global trade, logistics and transport enabler, we will strive to meet their high expectations and deliver for the people of Sudan,” Osama Abdellatif, Chairman of Invictus Investment Company PLC, said.

In 2018, news reports said that Qatar Ports Management Company was to invest in a new $4 billion Sudanese port facility at Sawakin, but nothing appears to have come of the venture.

According to Al Jazeera TV, a domestic Sudanese political dispute led to the closure of Port Sudan for 48 days last year.

Chittagong port authority, shippers are in a row over cargo palletization

(Container News)

Monday, 02 January 2023

The port users, shipping agents, and the Chittagong Port Authority (CPA) are in a tussle over a recent instruction issued by the port authority on “proper” palletisation of cargoes that comes in and goes out through Bangladesh's major port.

Through a notification issued on 24 November, the port authority made mandatory proper packing and attachment of shipping marks on all cargoes in line with the set standard from 1 January or face legal actions.

“It is observed that in some cases proper instruction is not followed which creates complexities in stacking LCL cargoes and delivery of the LCL/FCL cargoes to the concerned C&F agents or consignees representatives,” the notification said.

“Besides, the risks of fire incidents are increasing since the cargoes are not being palletized and packed properly,” it added.

In the notification, the port authority requested all concerned to palletise/pack all the LCL and FCL cargoes according to the set standard for smooth and safe port operation accordingly. “Otherwise legal actions will be taken against the concerned as per the ordinance of Chittagong Port Authority with effect from 01.01.2023,” pointed out the port authority.

The notification irked the port users, particularly the garment exporters who are large importers of raw materials, as huge financial involvement is linked with the proper palletisation.

Moreover, packing the cargoes by using layers of plastic wrap-around (covering the respective consignments) and securing with wooden plank/frame structures will further enhance the risk of fire incidence since plastics and wooden plank are highly inflammable, they claim.

Faruque Hassan, president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), in a letter to the port chairman last week said the palletisation cost in Far East from where its member industries source their raw materials- is astronomically high and the difficult cost edge they are facing internationally will be further impeded.

“Our sector will be driven in a tight corner against massive competition globally and we would like to put in record that our assurance to the government on forthcoming export target will be severely compromised if you implement the contents of your referred circular,” he wrote.

In a scenario of foreign exchange limitations, the balance of payment conditions, tough competition from other countries, constraints on gas and electricity supply impeding the running of garment factories, “your circular which for us is a ‘bolt from the blue’ will only add fuel to the fire, which we would like to put into record as our note of caution”.

He said the part of the circular stating sans palletisation ‘risks of fire incidence are increasing’ is “arbitrary, of no basis and untenable”.

Additionally, he questioned the compulsory implementation deadline of the new measure from 1 January 2023 and termed the threat of taking legal action as “extremely unfair, illogical, impractical” as import laden containers and containers on board vessels both under pipeline for all practical purposes will continue to turn at CPA well into March 2023 as inbound from various global destinations.

“Trade and commerce is not conducted on overnight circulars and ‘firmans’ of concerned authorities. Rather is based on evaluation of cost factors and whether these new costing are commensurate to respective and individual importers and suppliers and ultimate garment buyers price tag pre-advertised several months before they arrive in the shelves apropos to and peculiar with on-coming respective seasons,” he noted.

Hassan requested the port chairman to withdraw or keep the new rule in abeyance pending further discussion with trade in general and the BGMEA in particular till the end of 2023.

Syed Mohammad Arif, chairman of the Bangladesh Shipping Agents Association in a separate letter to the port chairman also requested to postpone implementation of the circular and review palletisation/packing applicable on cargoes categorically for better understanding and removal of confusion of concerned parties.

He wrote that the circular has created serious confusion among shipping agents and their foreign counterparts because palletisation depends on different factors like size, nature, and buyer’s requirement of cargo.

He further noted that palletisation may not completely solve the apprehension of the risk of fire incidents. Moreover, general imports/break bulk cargo are being imported and stored in sheds without palletisation but incidents of fire have not been experienced on the question of palletisation.

CPA spokesperson Omar Faruk could not be reached for comment on this issue despite several attempts.